Market Outlook

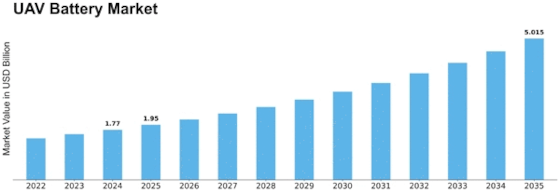

As the UAV Battery Market — often an afterthought in the early hobby-drone era — are becoming mission-critical. The latest estimates suggest the UAV battery market will grow from around USD 1.61 billion in 2023 to approximately USD 5.0 billion by 2035 (CAGR ~9.9%).

Industry Overview

Drones are increasingly used for commerce, defence, agriculture, logistics and environmental tasks. In each case, the battery system dictates how long the drone can stay airborne, how much payload it can carry, and how quickly it can be turned around. Moreover, the cost and weight of the battery often determine whether a given UAV mission is economically viable. Hence, the UAV battery market is intricately tied to the broader growth of drone applications.

Technological innovation is a key enabler: improved energy density, higher voltage systems, faster charging, modular/swappable packs, smarter battery management systems (BMS) and better thermal control. At the same time, regulatory and sustainability pressures drive demand for safer, lighter, recyclable battery systems. The industry is thus evolving from commodity battery packs to specialised aviation-grade power systems.

Key Players

Major companies operating in the UAV battery market include:

- VARTA AG – a prominent supplier of UAV-specific battery solutions.

- Ballard Power Systems – focus on fuel-cell powered UAV batteries for longer endurance missions.

- Sion Power Corporation – bringing lithium-metal cell innovations to the UAV segment.

- Others: Panasonic, Samsung SDI, LG Energy Solution, Saft Groupe, A123 Systems – all part of the competitive landscape.

Segmentation Growth

The UAV battery market can be parsed through several segmentation lenses: - By Application: Different missions impose different battery demands. Military UAVs (surveillance, combat) are among the highest value, while commercial applications (inspection, delivery) are expanding rapidly. In 2024, the military segment was estimated around USD 0.55 billion, to grow toward USD 1.55 billion by 2035.

- By Battery Type: Lithium-ion holds the largest share today, but lithium-polymer, fuel-cell and other advanced chemistries are gaining ground given the need for longer flight durations, lighter weight and higher safety.

- By End Use & Voltage Range: End uses span private (recreational), government and industrial. Meanwhile, battery systems are classified by voltage: below 12 V, 12-24 V, 24-48 V and above 48 V. Higher end voltage systems serve heavier UAVs with industrial or military missions.

- By Geography: Regions with strong UAV adoption and battery innovations (North America, Europe) currently dominate; yet fast growth is projected in Asia-Pacific and Middle East/Africa as commercial and defence UAV use expands.

Closing Thoughts

In short, the UAV battery market is a strategic enabler for the broader drone ecosystem. Battery innovation defines what drones can do — how far, how high, how long. Firms that integrate battery systems closely with UAV platforms, mission profiles and end-customer needs will be the winners in this space.